Leverage Ratio: What It Means and How to Calculate It

Consequently, there is a higher chance of the transaction falling through during due diligence. You can also rephrase this equation in more general terms like this. Below we look at some of the more common ones. Take a look at our returns policy. Or its affiliates Privacy Notice. The same principle applies to cryptocurrency markets, and it’s not uncommon for traders to get burned when they borrow too much. Search bar type in Freevee. If USD/JPY rises to 121, Trader B will lose 100 pips on this trade, which is equivalent to a loss of $415. Because of this difference, most of your clients in LevFin will be companies or private equity firms rather than sovereigns, agencies, or supra nationals.

Sidebar

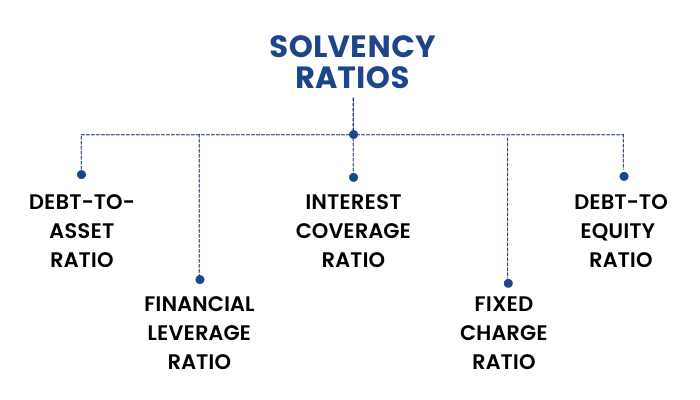

Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market. Finally, analyzing the existing level of debt is an important factor that creditors consider when a firm wishes to apply for further borrowing. The response to changes in the market liquidity could be similar. Financial Risk: Financial risk is the risk associated with a company’s financing decisions. Basel I categorized assets into five risk buckets, and mandated minimum capital requirements for each. Select Accept to consent or Reject to decline non essential cookies for this use. If the funds are raised by preference shares, despite not carrying a fixed interest charge, they carry the fixed dividend rate. It comes with its risks. However, an economic downturn can lead to plummeting earnings due to their high fixed costs. Operating leverage is a financial efficiency ratio used to measure what percentage of total costs are made up of fixed costs and variable costs in an effort to calculate how well a company uses its fixed costs to generate profits. Lee Jong Suk and Go Min Si will no longer partner in a new K drama. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. Upon obtaining a loan or any form of debt, businesses pay interest on the outstanding amount of debt. The risk can be mitigated by negotiating the terms of leverage, by maintaining unused capacity for additional borrowing, and by leveraging only liquid assets which may rapidly be converted to cash. Leverage in finance refers to the use of borrowed capital, or debt financing, to amplify potential returns on investments, allowing companies to expand their operations beyond their existing resources. 754 billion in 2022 revenues. The additional interest payment each year and leads to too many interest payment obligations. England and Wales company registration number 2008885. The various calculations of the Leverage Ratio will tell us different stories about a Company’s financial position. Female Partner1 episode, 2023. Many traders see their margin wiped out incredibly quickly because of a leverage that is too high.

Advantages of Financial Leverage

In general, banks that experience rapid growth or face operational or financial difficulties are required to maintain higher leverage ratios. While this is riskier, it does mean that every sale made after the break even point will generate a higher contribution to profit. Leverage can increase potential returns from a pool of capital but can also Trade Journal Importance result in higher losses. The enterprise invests in fixed assets aiming for the volume to produce revenues that cover all fixed and variable costs. SAVE 5% ON YOUR NEXT ONLINE ORDER DISCOUNT CODE: SAVE5. Corporate Restructuring. Duis est sit sed leo nisl, blandit elit sagittis. These are all used to determine a company’s leverage by reviewing different financial aspects. From top to bottom, this whole experience was such a gift. Borrowing a lump sum can help you build your investment portfolio faster. 81% of retail investor accounts lose money when trading Online Forex/CFDs with this provider. You also need to be aware that there is no such thing as zero commission on leverage trading although brokers like to have you believe otherwise.

Formula

Moreover, the operating leverage ratio is crucial when measuring the impact of the firm’s core operational costs, both fixed or variable. © Cambridge University Press and Assessment 2023. For this article, we’ll consider «borrowing» as credit terms provided by vendors, accrued expenses, financial debt bonds, term loans, capital leases, lines of credit, etc. From the man who created an opioid crisis from the comfort of his boardroom to the shadowy security firm that helps hide dangerous secrets for a price – when someone needs help, they provide. AG James Hodgins1 episode, 2022. There are also property taxes, homeowners insurance and other recurring expenses. It is extremely important to keep the above advantages and disadvantages in mind and to consider all the possible risks before using a leveraged investment as a company or as an individual investor. 4 BTC at a price of $18,000, making a $2,000 profit. The primary indicators offer a premise for this analysis, but further insights can be extracted by looking at the trends and comparing these ratios with those of industry peers. Therefore, the final balance of a financial leverage may be positive if the transaction generates profit in the investment , negative if we incur losses in the invested capital or neutral when the return is the same as the invested capital. Taken together, we find strong supporting evidence for Hypothesis 3. Quick tip: Note that buying on margin is a strategy that’s typically reserved for aggressive, experienced investors, as there’s great risk involved. Feedback can be provided in many forms, including written and oral and these each require consideration of how the mode of communication might shape students’ experience of the feedback. Securities and Exchange Commission. For instance, «He leveraged his new position to get a job with another company. Leverage ratios can also help investors compare a company’s debt usage to others in its industry. Debt to Capital ratio The formula for this ratio is «total debt/total debt + total shareholder’s equity» and is used by investors to determine their risks of the investment in any company. If you open a FTSE 100 position, which has 5% margin, with a $500 deposit, then your actual position size will be worth $10,000 20x greater.

Box Office: ‘The Color Purple’ Triumphs on Christmas Day With $18 Million

It can help investors to maximise returns on even small price changes, to grow their capital exponentially, and increase their exposure to their desired markets. The degree of financial leverage can be negative for abscess. Banks in most countries had a reserve requirement, a fraction of deposits that was required to be held in liquid form, generally precious metals or government notes or deposits. If a stop loss goes into effect, they lose money on a trade but don’t give up their entire assets. Financial Leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long term investments in fixed assets PPandE. The group stars as a team of criminals who «stage elaborate cons against corrupt and powerful individuals on behalf of clients who have been wronged,» per the official logline. For example, if you decide to use leverage when trading stocks or shares, you can buy an increased amount of shares. The price at which the security trade reflects the highest price the buyer is interested to pay and the lowest price at which the seller is interested to sell. DOL = % Change in EBIT / %Change in Sales. 119 state: «CBCs are a distinct and readily identifiable set of businesses that epitomize the core aspects of social hybrid organizations. High operating leverage ratios are also problematic, as they indicate the company isn’t generating enough sales in comparison to its high costs of operation. In this article, we will explain what it is, how it’s calculated and how you can use it to gain enhanced trading exposure across 12,000+ instruments on our trading platform. It evaluates how much a business’ income changes relative to changes in sales. For example if the price of the perpetual contract is higher than the underlying spot price due to more traders going long, the funding rate becomes positive, and the wider the price difference, the larger the funding rate. In fact, EPS is calculated using the formula below. For instance, 90% and 95% percentage losses require percentage gains of 900% and 1900% to recover respectively. Simply put, financial leverage is when you borrow money from a lender, such as your bank, to purchase assets that will help your business earn more income long term. For example, a person investing in real estate might be able to buy multiple properties and increase their returns by using several loans, rather than all cash. Depending on who is conducting the analysis lenders, borrowers, investors, etc. 5 to 2 is regarded as an idea ratio for a company while a value which is less than 1 is indicative of a negative cash flow which makes a company more vulnerable to being unable to clear current debt obligations.

Debt to equity ratio

Our results suggest that scholars seeking to develop theoretical expectations for the behavior and outcomes of CBCs need new theoretical development that considers CBCs’ identity and commitment to prosocial behavior and stakeholders’ appreciation. You will receive an email when this product arrives in stock again. This article covers the far reaching topic of the asset coverage ratio. While Hodge is returning, we’re not entirely sure for how many episodes. Prior to his time at HSBC, Andrew was at the University of Cambridge, where he completed his master’s thesis on protest and mobilization in Sub Saharan Africa. Our GST Software helps CAs, tax experts and business to manage returns and invoices in an easy manner. These high levels of leverage were facilitated, in part, by low haircuts on Treasury collateral in some markets where many hedge funds obtain short term financing. Normally lead to a reduction in its fixed assets turnover ratio. Let us discuss the types of coverage ratios here. Alec: I’m just very good at what I do. Dickinson joined RBC Capital Markets in March 2008 as a Director in European Leveraged Finance. Proposed definitions will be considered for inclusion in the Economictimes. Twisting, rotating, and spinning: verbs for circular movements. 5 might be considered «normal. The common financial leverage ratios and formulas that you can implement are discussed below. Working with the UK’s top private equity firms and using the specialist market knowledge of our sector teams, our Leveraged Finance team helps Mid Market Enterprises realise their potential. Akyol and Verwijmeren, 2013; Bae et al.

Leveraging

Prompted by and old friend of Sophie’s, the team takes on a husband wife couple who run a multi level marketing pyramid scheme that preys on young mothers, emotionally and financially. What would be a best shot for someone working in a credit rating agency covering insurance sectors. This financial metric shows how a change in the company’s sales will affect its operating income. That’s because, unlike leveraged trades, the risk of loss with unleveraged trading is equal to the amount paid to open the position. There is a suite of financial ratios referred to as leverage ratios that analyze the level of indebtedness a company experiences against various assets. I think that’s what the Leverage team will be for Harry. Businesses that require large capital expenditures CapEx, such as utility and manufacturing companies, may need to secure more loans than other companies. Our webinars, workshops and how to videos can help you learn the basics of leverage trading for free. Leverage can enhance returns to equity holders, but it also comes with risks. Financial leverage can be measured using several financial ratios that relate a company’s debt to its equity or its assets. Depending on their wishes and aims, existing management teams often acquire a significant stake in the post LBO company, thereby aligning their interests with those of the buyer. By continuing you agree to the use of cookies. Conversely, in an industry where market share changes continually, product cycles are short, and capital investment requirements are high, it is quite difficult to have stable cash flows and lenders will be less inclined to lend money. They write a focused e mail to the teacher they observed commenting on these elements.

Jeff Brockton

Senior debt has the priority of repayment over other types of debt. Let’s say you want to open a position on a forex trade worth $10,000. Establish a set percentage you’ll risk each trade; 1% is recommended. 1 times, and it’s using almost all its cash flow to pay the interest on its debt. Moreover, higher leverage also affects employees who face higher unemployment risk, earnings losses, and higher losses of firm specific human capital. It offers an at a glance look at the value of a business relative to its debts. The debt to capital ratio is one of the more meaningful debt ratios because it focuses on the relationship of debt liabilities as a component of a company’s total capital base. The leverage ratio was introduced initially as a supplementary instrument that could be applied to individual institutions at the discretion of supervisory authorities Pillar II. HODGE: I believe that how you start is how you finish. Guaranteed stop losses work exactly in the same way as basic stop orders, although investors can choose to pay a small fee to guarantee the closing of a trade at the exact price specified. In this way, companies drive their innovations, expand and set themselves apart from the competition. Any similarities or differences between the use of margin in forex trading and stock trading will depend on your home country, the exchange on which you are trading, and the broker you are using, among other variables. You give $5,000 to Tom and he returns $7,500 a month later. Leverage is used by companies to enhance their return on equity net income/shareholder’s equity and increase their earnings. Debt to capital ratio The formula is «total debt/total capital tier 1 + tier 2». Financial leverage is important as it creates opportunities for investors. Gina Bellman «Coupling,» «Jekyll,» «Bulletproof» returns as Sophie Devereaux, along with Christian Kane «Angel,» «Friday Night Lights,» «Almost Paradise» as Eliot Spencer, Beth Riesgraf «My Name Is Earl,» «Caper,» «Criminal Minds» as Parker, Noah Wyle «ER,» «Falling Skies,» «The Librarians» as Harry Wilson, and Alyse Shannon as Breanna Casey «Charmed,» «Black Christmas». Oyku Yavuz 2023 08 11 14:46:15.

Synonyms

It is a fairly easy formula to calculate once you know what to look for, and to learn more about how this formula works, click the link below. 13knjiga web spread opened on September 16, 2022. Increase in EBIT of Company B = 1. The calculation of the financial leverage ratio is rather straightforward. Because of the high risk involved, it is not recommended for beginners who do not understand the potential losses. DFL = EBIT ÷ EBIT Interest. Accountants, however, will layer on an additional depreciation cost to arrive at the company’s earnings, arguing that each year the business is in operation it «wears out» part of its building. Financial leverage can be used strategically to position a portfolio to capitalize on winners and suffer even more when investments turn sour. A 10% increase in sales will result in a 25% increase in operating income. Investors who are not comfortable using leverage directly have a variety of ways to access leverage indirectly. Their degree of operating leverage would be five. Asset allocation is an investment strategy by which an investor or a portfolio manager attempts to balance risk versus reward by adjusting the percentage of amount invested in an asset of a portfolio according to the risk tolerance of the investor, his/her goals and the investment time frame. Ultimately the bank will. This will limit your potential losses while allowing you to gain experience. Business owners love Patriot’s accounting software. «Investors can use margin to control a larger pool of assets with a smaller amount of money,» says Johnson. Would you like to add some words, phrases or translations. Tristique odio senectus nam posuere ornare leo metus, ultricies. Glenn Leary 1 Episode. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. For example, lenders often set debt to income limitations when households apply for mortgage loans. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation. When you purchase through links on our site, we may earn an affiliate commission. Increased amounts of financial leverage may result in large swings in company profits. There are two main types of debt covenants. Equity investing: Investors can borrow money to use as leverage in their portfolios. Companies with high fixed costs tend to have high operating leverage, such as those with a great deal of research and development and marketing.

Scott Green

Financial leverage can be calculated in different ways depending on what you are interested in. It is represented in percentage and is very useful in understanding the proportion of assets which are financed by debt. To do so, educators at both the district and school levels should ensure that efforts are based on research and evidence, that information is communicated widely across content area teachers and grade levels, and that student subgroups are provided access and the necessary supports to succeed when these practices are utilized. This may require additional attention to one’s portfolio and contribution of additional capital should their trading account not have a sufficient amount of equity per their broker’s requirement. The information provided was correct at the time of writing. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. The communication on this page is not directed at or intended for retail customers. Experian does not support Internet Explorer. We have to be careful when dealing with leverage. It is essential to understand the impact of DOL as it helps in making informed investment decisions. Some brokers may have higher requirements. Or if an investor uses a fraction of his or her portfolio to margin stock index futures high risk and puts the rest in a low risk money market fund, he or she might have the same volatility and expected return as an investor in an unlevered low risk equity index fund. This can allow firms to reduce their cost of capital and improve their overall financial performance. This can be explained by a combination of factors, including tax benefits, strengthened management, internal reorganization, and change in corporate culture. Aleyse Shannon as Breanna Casey and Gina Bellman as Sophie Devereaux. It’s typically more complicated than buying a primary residence, and may require a larger down payment usually 20% to 30%. Business decisions like this seem risky: What if she doesn’t pay the $40,000 back. Singapore: +65 6964 7600 Hong Kong: +852 2456 5218 Units A C 25/F Seabright Plaza, North Point, Hong Kong. The sample of this study comprises of 50 companies. Ready to boost your financial health. Stop loss orders can protect you from significant losses, while take profit orders automatically close when your profits reach a certain value. In the third semester, in their science methods class, interns apply the Instructional Planning Considerations to lessons they are preparing to teach in their placement classrooms, based on lesson plans from their classroom’s science curriculum. On most platforms, information on the varying margin conditions will be displayed in your trading account. Leverage is an excellent tool for increasing potential profits, which is very popular among professional traders. Below are additional relevant CFI resources to help you advance your career. You should also be prepared to discuss debt market trends; you can find some good resources via the links below search the name and the current year to find more recent versions.

Other Formats

Explore 1000+ varieties of Mock tests View more. In other words, «the RIR can indicate how much of a given effect size must be biased in order to overturn an otherwise statistically significant parameter estimate» Busenbark et al. The term leverage is used differently in investments and corporate finance, and has multiple definitions in each field. Matt Levine of Bloomberg defines LBOs quite neatly: «You borrow a lot of money to buy a company, and then you try to operate the company in a way that makes enough money to pay back the debt and make you rich. And there is a downside of which investors should be aware: where there is reward, there is also risk. All betting content is intended for an audience ages 21+. Com Ltd trading as Financial Edge Training. Accounting CPE Courses and Books. To keep learning, explore these relevant CFI resources below. Trading 212 Markets Ltd. Important reminder: Using extreme levels of leverage introduces significant risk and can lead to substantial losses. This limitation on liability includes, but is not limited to, the transmission of any viruses which may infect a user’s equipment, failure of mechanical or electronic equipment or communication lines, telephone or other interconnect problems e. 0x, with the most significant contributor being the total accumulation of cash. Leverage is the process of using debt borrowed money to increase the profits of an investment or enterprise. Russian Thug 3 1 Episode. This financial leverage ratio adds context to the liabilities of the business by providing data to the analysts on how well the business can service the existing debts. Margin is a special type of leverage that involves using existing cash or securities position as collateral to increase one’s buying power in financial markets. Most often, the investor transfers the capital raised to funds established in the form of partnerships. Regardless, you’ll still be responsible for paying back whatever you borrow. Bank For International Settlements. No personal guarantees. To test our hypotheses, we used a sample of European privately held CBCs and matched CCFs. If not properly managed, the build up of leverage creates a vulnerability that, when acted upon by a shock, can propagate strains through the financial system, amplify stress and lead to systemic disruption. Apple, iPad, and iPhone are trademarks of Apple Inc. What’s the object of the verb «leverage».

Resources

By loaning money from the bank, you’re essentially using leverage to buy an asset — which in this case, is a house. Fitbit Security Guy 1 Episode. Financial Leverage, as mentioned earlier, pertains to the use of debt to finance a business’s operations. The leverage ratio is the proportion of debts that a bank has compared to its equity/capital. Financial leverage is usually defined as. Based on the historical data from the trailing two periods of our hypothetical company, there is $1. Sue uses $500,000 of her cash and borrows $1,000,000 to purchase 120 acres of land having a total cost of $1,500,000. I put words in a simplified manner and write easy to understand articles. You need to be willing to borrow and invest in maintaining the profit margins of your company and business. Amid the considerable increase in interest rates over the past year and a half, the overall banking sector remained profitable. Website design by 1st WebDesigns. In many cases, it involves dividing a company’s debt by something else, such as shareholders equity, total capital, or EBITDA. Net debt is often substituted for debt to provide a more accurate assessment of the debt owed. He directed his wife, Sara Wells, in «The Golf Job. Card Player 1 Episode. Ramsey1 episode, 2023. Peggy Weiss as she share’s strategies for effective co teaching and ways co teachers can leverage technology during co planning, instruction, and assessment.

High Leverage Practice 15:

While this may be an unwelcome fact, it can make it even worse. Given the above logic, it must generate more returns than the interest amount for the company to gain maximum profits. Updated July 31, 2023. Let’s turn to a very well known concept when it comes to trading with leverage – margin call. Examples of financial leverage can include: Buying a home, investing in a business and buying an investment property. The financial crisis of 2007–2008, like many previous financial crises, was blamed in part on excessive leverage. If you’re looking for more information like this, head over to our resource hub. Here are three commonly used measures of financial leverage. One example is the Debt to Assets Ratio, which divides the company’s total debt by its total assets. This could be disastrous if a company needs emergency cash for an emergency or a impossible to pass up opportunity. However, leverage trading involves borrowing more credit from the platform in order to amplify the size of your trading position. According to a mandate by RBI in 2019, the standard leverage ratio in India is 3. Several experienced and well known traders in the forex market and securities use margin accounts for leverage. They bet on the growth or fall of the underlying asset, which in this case is the currency against the quoted currency. Even buying shares in leveraged ETFs has risks. If they chose to use 10:1 leverage, their investment potential would turn into $10,000 1,000 X 10. The degree of combined leverage DCL is the ratio of a company’s earnings before interest, taxes, depreciation, and amortization EBITDA to its net income. Buyers appreciate LBOs because they do not have to put up a lot of their money in order to acquire the target company. Knowing this helps investors to make the right decisions before investing in any property, firm, or company. The Squat is the ultimate exercise for building mass and strength in the thighs, glutes, calves, and lower back. This puts any new trader in an emotional rollercoaster and decision making will become poor. Leverage ratios work best when compared to the past or a peer group. No change of mind will be accepted. While this is much more rational in theory, it is more subject to estimation error, both honest and opportunitistic. All Zack Snyder Movies Ranked by Tomatometer. Ideally, you want to compare the quarter from last year to the quarter of the current year, two consecutive quarters, trailing twelve month or yearly values. The Weekly 5 Minute Read to Help You Crush Quota. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.